BC, Ontario Taxes Likely To Approach 60% in Federal Budget By Chrystia Freelands

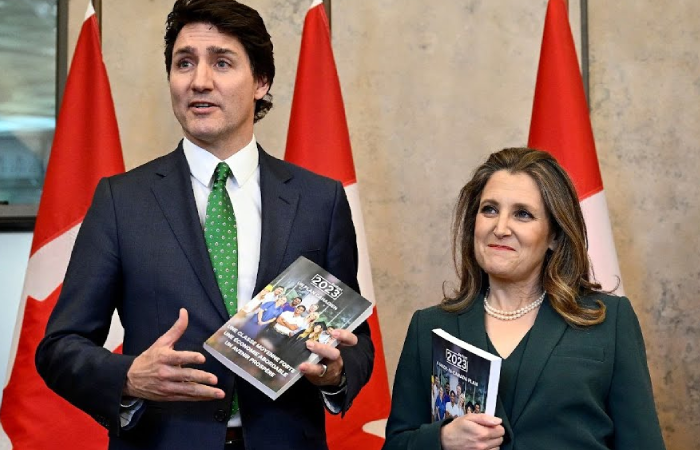

On March 28, Canada's federal budget plan was presented by Finance Minister Chrystia Freeland. Rumors had it that it includes anticipated tax rate rises.

According to Twitter user Global Macro, tax professionals they spoke with, suggested maximum tax rate might rise to 58.5% in British Columbia and 58% in Ontario.

Details Of The Budget

The Liberal government, unveiled a budget that increases the purchasing power of 11 million Canadians who have been hit by inflation while admitting it must prepare for a "mild recession.

It invests billions in health care and a national public dental care program. Also provides $80 billion over the next ten years in significant investment incentives. This is done to entice "clean" technology dollars to Canada in the face of severe competition from the U.S.

Chrystia Freeland, Canada's finance minister, defended her $497 billion budget as a "fiscally responsible" strategy that raises taxes on the richest while providing lower- and middle-income Canadians with a $2.5 billion extended GST credit to help offset the country's persistently high prices for food and other essentials

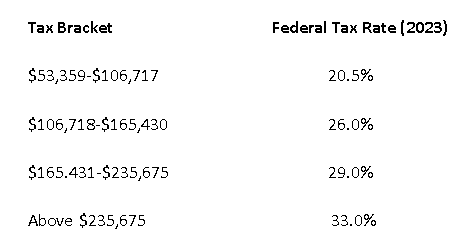

Insight into Tax Slab

-

The overall federal and provincial tax rates in Ontario range from 20.05% to 53.53%, with income tax rates in the province ranging from 5.05% to 13.16%. On all earnings above $222,420, the highest combined BC tax level is 53.50%.

-

Due to the significant inflation over the past year, the top federal tax rate currently begins to apply at an income of more than $235,675 for 2023.

-

This is an increase of 6.3% from 2022. According to the pre-election platform of the New Democratic Party, the highest rate will be increased by two percent to reach 35%.

-

In British Columbia, Ontario, Quebec, and Nova Scotia, the highest marginal tax rate after provincial taxes will be about 56% under this scenario, while in Newfoundland and Labrador it would increase to 57%.

-

Some analysts are looking for hints in the 226-page pre-budget report from the Standing Committee on Finance, which includes 230 detailed recommendations for spending and tax changes.

-

The suggestion includes things like "undertake a public review to identify federal tax expenditures, tax loopholes, and other tax avoidance mechanisms that particularly benefit high-income individuals, wealthy individuals, and large corporations and make recommendations to eliminate or limit them."

-

This is interpreted by many as an indication that significant tax adjustments will be made for high-income persons. Among other things, the measure may apply to capital gains and surplus income.

-

The government might decide to stop allowing sophisticated taxpayers to distribute their corporation's corporate surplus (basically, retained earnings for tax purposes) at capital gains rates rather than the higher rates for Canadian dividends, or through the payment of a salary or bonus. This popular private corporation tax-planning strategy is currently in place.

-

The Income Tax Act does not contain a general policy requiring shareholders to remove their surplus through dividends rather than capital gains, despite previous attempts by the Canada Revenue Agency to do so. As a result, courts have generally held that this type of planning is acceptable and does not break the general anti-avoidance rule.

-

The capital gains inclusion rate, which is now fixed at 50%, is also being increased by the NDP to 75%.

-

The tax bands experienced considerable changes, and for 2023 they were increased by 6.3% as a result of the significant increase in inflation in 2022.

Tax Bracket